Post-Wildfire Gentrification: The Unseen Aftermath in California Communities

In the charred aftermath of California’s devastating 2025 wildfires, another, quieter disaster is unfolding. As flames recede, a wave of economic displacement is reshaping communities already under strain. From Altadena’s historic Black neighborhoods to the broader housing markets of Los Angeles County, disaster recovery has collided with soaring land values, underinsurance, and systemic inequality. This article traces the deeper story behind the headlines: how climate catastrophe is fueling gentrification, exacerbating social divides, and forcing California to confront hard choices about who gets to rebuild—and who gets left behind.

A New Kind of Firestorm

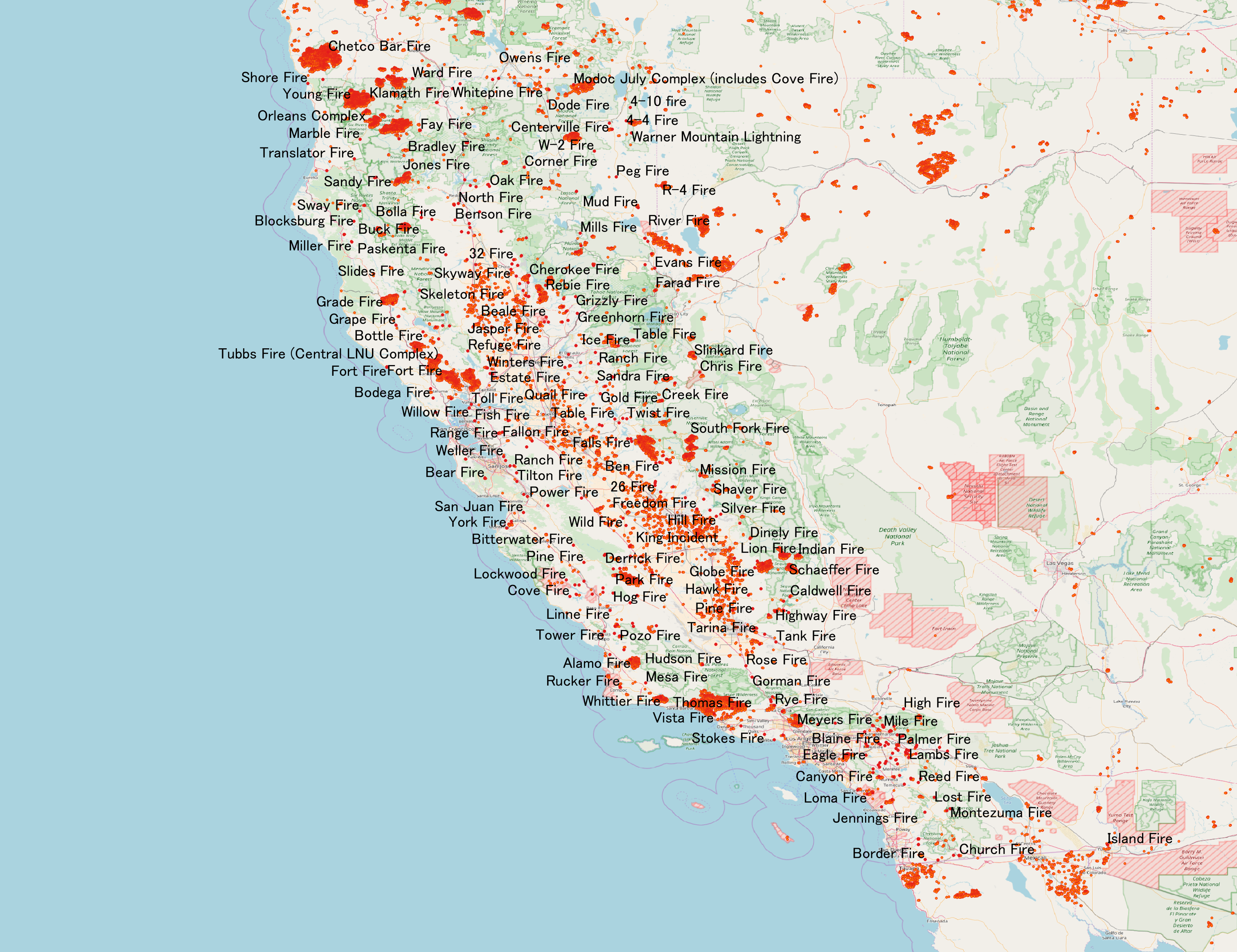

In January 2025, California entered yet another grim chapter of its ongoing battle against wildfires. The Eaton Fire, which ravaged Altadena and surrounding areas, destroyed over 9,500 structures and claimed the lives of 17 residents, according to Cal Fire estimates. For many, the immediate aftermath was visual: blackened hillsides, skeletal remains of homes, and a sky choked with smoke. Yet beyond the visible devastation, a quieter, slower-moving crisis has taken root—one far less understood but no less destructive. Communities once defined by their cultural vibrancy are now under siege from a very different kind of fire: economic displacement fueled by rebuilding booms and skyrocketing land values.

This phenomenon, increasingly referred to by urban sociologists as “disaster gentrification,” mirrors patterns seen after other American catastrophes—New Orleans post-Hurricane Katrina, or New York’s Lower Manhattan after 9/11. In California’s fire zones, however, the pace is accelerated by the state’s severe housing shortage and the hunger among developers for ‘blank slate’ opportunities. In communities like Altadena—where Black homeownership symbolized decades of resilience against segregationist housing policies—rebuilding does not simply mean restoration. It often means replacement. A 2025 UCLA Urban Displacement Project report found that post-wildfire redevelopment in Southern California correlates with a 23% faster rate of demographic change compared to non-disaster areas nearby. In essence, natural disasters are being weaponized by market forces, threatening to erase decades of cultural history under the guise of “recovery.” If left unchecked, California’s post-wildfire landscape will not just be scarred by climate disaster—it will be marked by the loss of its living heritage.

Altadena: A Case Study in Displacement

Altadena, perched against the San Gabriel Mountains, has long been more than just a suburb of Los Angeles. It has been a bastion of Black prosperity and cultural pride. Throughout the mid-20th century, it offered Black families—who were barred from homeownership elsewhere—an opportunity to build generational wealth and community institutions. By 1980, Census Bureau data recorded that 43% of Altadena’s population was Black. However, fast forward to 2025, and that number has plummeted to just 17%. The Eaton Fire, devastating in its own right, has acted as an accelerant to this demographic decline.

The data tells a stark story: Nearly 48% of Black households in Altadena reported total or near-total loss during the fire, compared to 37% among non-Black residents, according to the 2025 UCLA Anderson Wildfire Impact Study. The reasons are layered—many older Black homeowners, facing underinsurance or lacking the resources to rebuild quickly, found themselves forced to sell at distressed prices. Meanwhile, investors and wealthier newcomers, often flush with cash and looking for suburban footholds outside central Los Angeles, descended on the scorched landscape. A telling symbol: a vacant lot on West Calaveras Street—once a modest rental property—sold for $550,000, soaring over $100,000 above its listing price after a bidding war between outside investors, as first reported by ABC7 Los Angeles.

Such transactions are not just about real estate—they signify cultural erasure. Churches, barbershops, and Black-owned businesses—institutions that made Altadena more than a collection of homes—are under siege as well. With each flipped property and each displaced family, Altadena risks becoming another generic affluent suburb, stripped of the very soul that once made it extraordinary. Without intentional policy intervention, the fire that tore through Altadena’s hills may soon extinguish its historic heart as well.

Economic Aftershocks

The economic toll of California’s 2025 wildfires has proven staggering, reverberating far beyond the scorched landscapes and into the heart of the state’s financial ecosystem. Initial estimates from the LAEDC (Los Angeles County Economic Development Corporation) suggest that total damages and associated economic losses hover between $250 billion and $275 billion, positioning the 2025 wildfire season among the costliest natural disasters in American history. For Los Angeles County alone, the fires are expected to slash the region’s GDP by approximately 0.48%, translating to a staggering $4.6 billion loss in economic activity over the year. Wage losses, equally alarming, are projected at around $297 million, according to a report by the UCLA Anderson Forecast, with over 49,000 job-years potentially wiped from the regional economy over the next five years.

Yet, these numbers only tell part of the story. The real human cost lies in the asymmetrical impact the economic shockwave has had on California’s most vulnerable populations. Lower-income residents, many of whom lacked robust insurance coverage or savings cushions, are facing prolonged displacement and deepening financial precarity. Small businesses—often the backbone of local economies—have shuttered at alarming rates, with minority-owned enterprises among the hardest hit. FEMA assistance, while vital, has proven insufficient for the sheer scale of need. Experts warn that without deliberate, equity-focused recovery programs, the fires could permanently alter California’s socio-economic landscape, pushing tens of thousands into poverty while accelerating wealth consolidation among land speculators and corporate developers.

Housing Market Pressures

California’s wildfire devastation has collided head-on with an already precarious housing crisis, creating a combustible situation for displaced residents. The destruction of over 10,000 homes statewide has tightened an already limited housing supply to a breaking point. In fire-affected areas like Altadena, Paradise, and portions of Sonoma County, rental prices surged by an estimated 15–20% within just six months after the fires, according to analysis from the Urban Institute. In some cases, particularly where temporary housing was in especially short supply, rents have nearly doubled, placing immense pressure on families struggling to rebuild their lives.

This affordability squeeze has exposed and amplified longstanding structural issues within California’s housing market. Investors and developers, often armed with cash offers, are snapping up whatever properties remain, fueling bidding wars that local residents—many of whom are dealing with insurance disputes or income disruptions—simply cannot compete with. According to CoreLogic data, institutional investors accounted for up to 22% of home purchases in affected zip codes in the first quarter of 2025, compared to just 9% in the same period in 2023. This influx of speculative buying threatens to not just recover—but reconfigure—the communities themselves. The risk is that fire-ravaged working-class neighborhoods will be reborn not for their former residents, but for wealthier outsiders seeking suburban havens far from urban centers.

Policy Implications

As California stands at the intersection of climate disaster, housing policy, and economic inequality, it is clear that piecemeal solutions will no longer suffice. Advocates and urban policy scholars argue that comprehensive interventions are urgently needed to break the cycle of destruction and displacement. One such measure gaining traction is the push for equitable rebuilding frameworks that prioritize the needs of historically marginalized communities. This includes mandating a percentage of all new housing built on fire-affected lands to be permanently affordable, ensuring that lower-income families have the legal right and economic means to return. Organizations such as the California Community Foundation have also called for expanded grant programs to cover insurance gaps for underinsured survivors.

Reforming land use and zoning policies has become a top priority. Critics argue that rebuilding in known high-risk fire zones without updated land-use regulations is fiscally reckless and morally questionable. Proposals include stricter setback requirements, prohibition of new construction in the most vulnerable areas, and state-subsidized buyouts for properties located in extreme risk zones—a model successfully tested in parts of New Jersey after Hurricane Sandy. Reform in the insurance industry is equally critical. Experts suggest the establishment of a state-backed catastrophic insurance fund to spread wildfire risks more equitably across the population. Without these systemic interventions, California risks perpetuating a pattern where disaster recovery deepens inequality, erases communities, and fosters new vulnerabilities for future crises.

Insurance and Rebuilding Challenges

In the aftermath of the 2025 wildfires, insurance—once seen as a reliable safety net—has instead emerged as one of the largest obstacles to recovery. Facing mounting wildfire-related losses year after year, major insurers like State Farm and Allstate announced in early 2025 that they would no longer issue new homeowner policies in much of fire-prone California, citing “growing catastrophic risks” and “unsustainable loss ratios.” Existing policyholders found themselves grappling with non-renewals, sudden premium hikes, and stricter underwriting requirements. Homeowners in high-risk zones were increasingly forced onto California’s FAIR Plan, the state-mandated “insurer of last resort,” which offers basic fire coverage—but at premiums that have soared to an average of $3,200 annually in 2025, up 22% from just two years ago, according to data from the California Department of Insurance.

This systemic insurance pullback has left many residents underinsured or completely uninsured at the very moment they need support the most. Reports from AP News document heartbreaking cases where fire survivors, assuming they were adequately covered, learned that their payouts would cover only 60–70% of actual rebuilding costs. The shortfall, often amounting to hundreds of thousands of dollars, is beyond the reach of working- and middle-class families already burdened by California’s cost of living crisis.

Looking Ahead

The challenges facing California in the wake of the 2025 wildfires are immense, but they are not insurmountable. How the state chooses to rebuild—both physically and socially—will determine whether this disaster becomes another chapter in a long history of inequity, or a pivotal moment for transformative change. The path forward demands policies that do not merely aim to “return to normal,” but instead reimagine what a resilient, inclusive, and just California could look like.

At the heart of this vision must be an unwavering commitment to safeguarding vulnerable communities, ensuring that recovery efforts actively counter displacement and foster community-led redevelopment. Strengthening affordable housing infrastructure, overhauling the insurance landscape, and embedding climate resilience into urban planning must move from talking points to funded mandates. Investments in local businesses, community land trusts, and resident-driven planning initiatives can help preserve the social fabric that disasters so often shred. California has an opportunity—perhaps its last best chance—to rebuild in a way that honors not just the loss of land and property, but the preservation of its diverse communities and histories. In doing so, it can become a national model for disaster recovery that is rooted not in exclusion and erasure, but in justice and renewal.

Related articles

Architecture Professional Degree Delisting: Explained

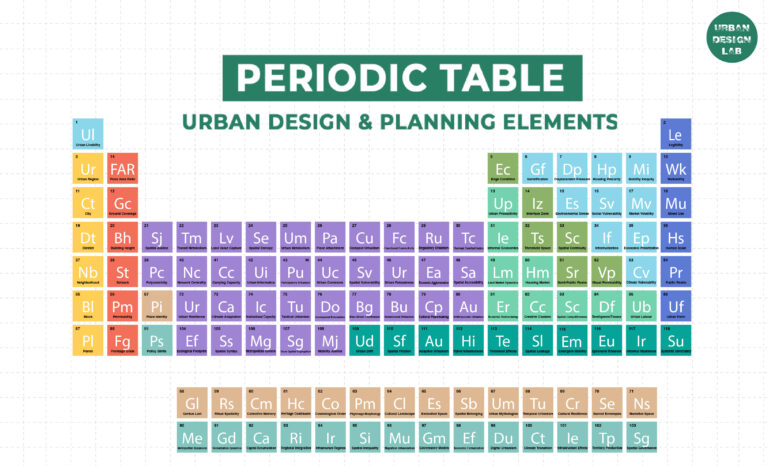

Periodic Table for Urban Design and Planning Elements

History of Urban Planning in India

Best Landscape Architecture Firms in Canada

UDL GIS

Masterclass

GIS Made Easy – Learn to Map, Analyse, and Transform Urban Futures

Session Dates

23rd-27th February 2026

Urban Design Lab

Be the part of our Network

Stay updated on workshops, design tools, and calls for collaboration

Curating the best graduate thesis project globally!

Free E-Book

From thesis to Portfolio

A Guide to Convert Academic Work into a Professional Portfolio”

Recent Posts

- Article Posted:

- Article Posted:

- Article Posted:

- Article Posted:

- Article Posted:

- Article Posted:

- Article Posted:

- Article Posted:

- Article Posted:

- Article Posted:

- Article Posted:

- Article Posted:

- Article Posted:

- Article Posted:

Sign up for our Newsletter

“Let’s explore the new avenues of Urban environment together “