Land Value Capture: Funding Urban Development through Infrastructure Investment

Land Value Capture (LVC) is a financial tool that enables governments to capture the increase in land value created by public infrastructure investments. Effective LVC ensures that those who gain the most from such improvements contribute toward the cost, thus supporting just urban growth.

Type of LVC

- Development-based.

- Tax- or fee-based.

Success stories include Grand Paris Express, New York’s 7 Line Extension and Hong Kong’s Rail + Property, all of which applied LVC to finance mega scale infrastructure works.

However, there are some constraints that entail vagueness in legal frameworks, public hostility to LVC, and high upfront investment costs but offers more opportunities for sustainable funding of infrastructure, balanced growth, and development of PPP. Also recent technologies like GIS and big data will enhance the effectiveness of LVC.

Bring a sustainable and fair response to the ever-growing needs of urban infrastructure of cities in order to manage budgets, enhance services, and create an environment that is more livable for the citizenry.

Understanding Land Value Capture: A Tool for Urban Growth and Equity

Concept of Land Value Capture (LVC)

Land Value Capture (LVC) is a concept that was first proposed by David Ricardo (1821) with Ricardo’s land rent theory which further expanded upon by Henry George (1829). Later William Alanso proposed Bid rent theory in 1964 that describes the variation in real estate price and demand as one moves away from the central business district (CBD).

“Land value capture (LVC) is a way for governments to use the increase in land value caused by changes or projects to fund infrastructure or community improvements”. It ensures that those who benefit most from development contribute their fair share to the cost. (Suzuki et al., 2015).

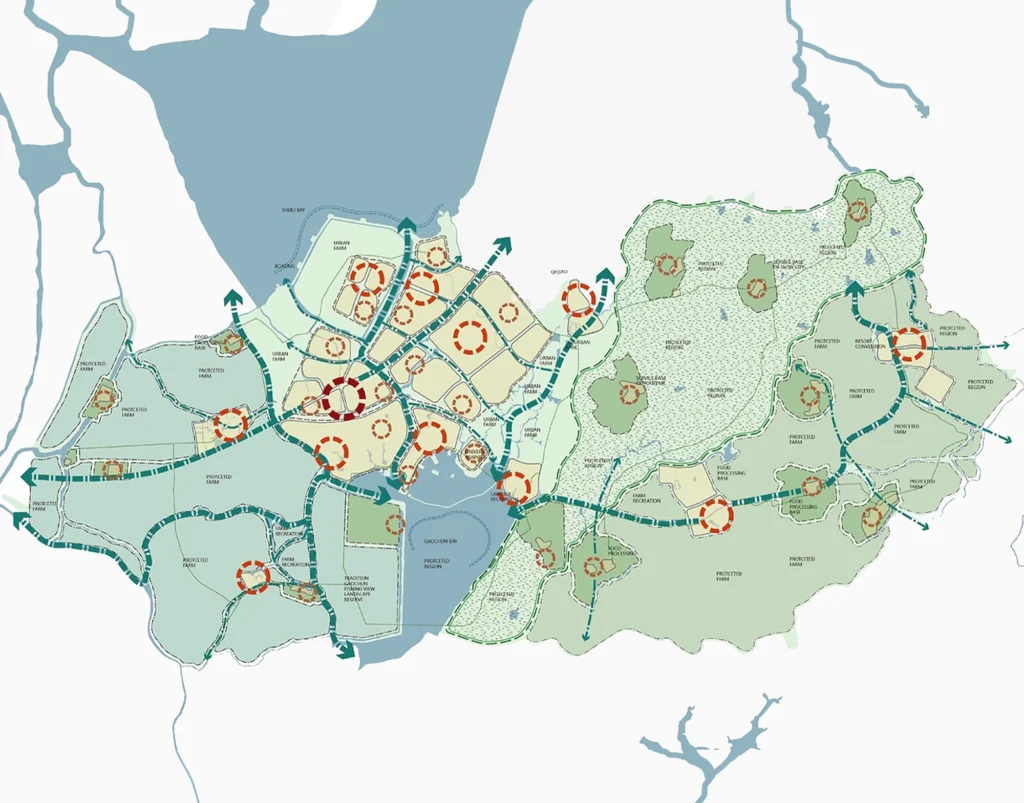

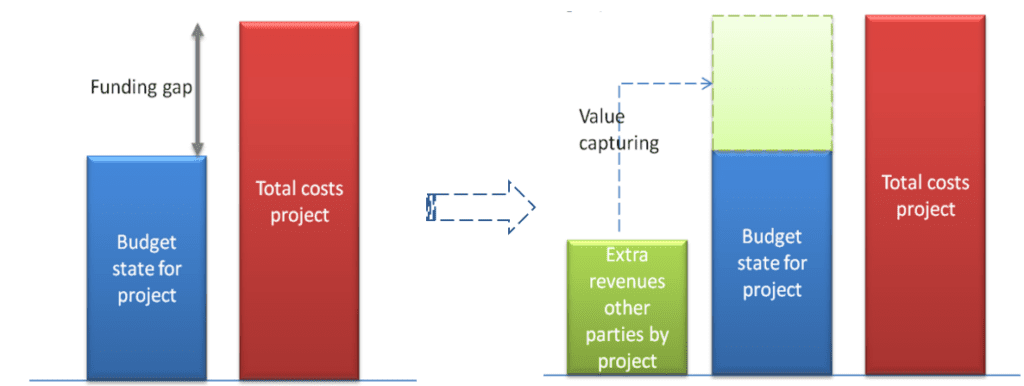

The diagram shown in figure illustrates the process of value capturing.

PRINCIPLE

- Value capture is a concept that recognizes how private properties benefit from public investments in infrastructure and government policies.

- By using suitable tools, a portion of the increased value of land and buildings can be captured.

- This captured value can then be reinvested into public projects by governments at various levels.

This creates a positive cycle where value is continually created, captured, and reinvested for the benefit of the public (MoHUA, 2017).

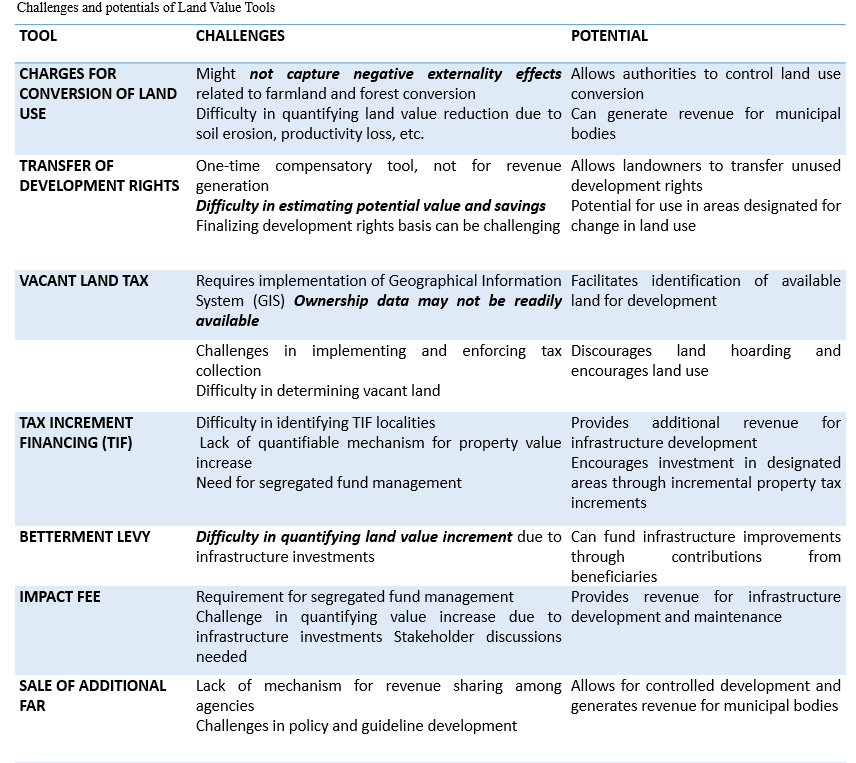

Mechanisms of Land Value Capture: Exploring Financial Tools and Strategies

The concept of land value capture has been derived from the financial hardship of developing countries.

“It is an alternative source of new revenue by investing in public infrastructures. Income coming from this source works because those who benefit from the infrastructure are expected to pay toward investment costs that prevent undervaluation of public goods.”

It’s fair in that those who did not contribute to increased land value take no financial benefit which one would use for funding projects for the greater good.

The surplus value in land appearing in land value assessments can either be retained with individual owners as a form of additional asset or be appropriated by the government for public benefits. Yet liberal economic theory asserts that this value creator should retain it.

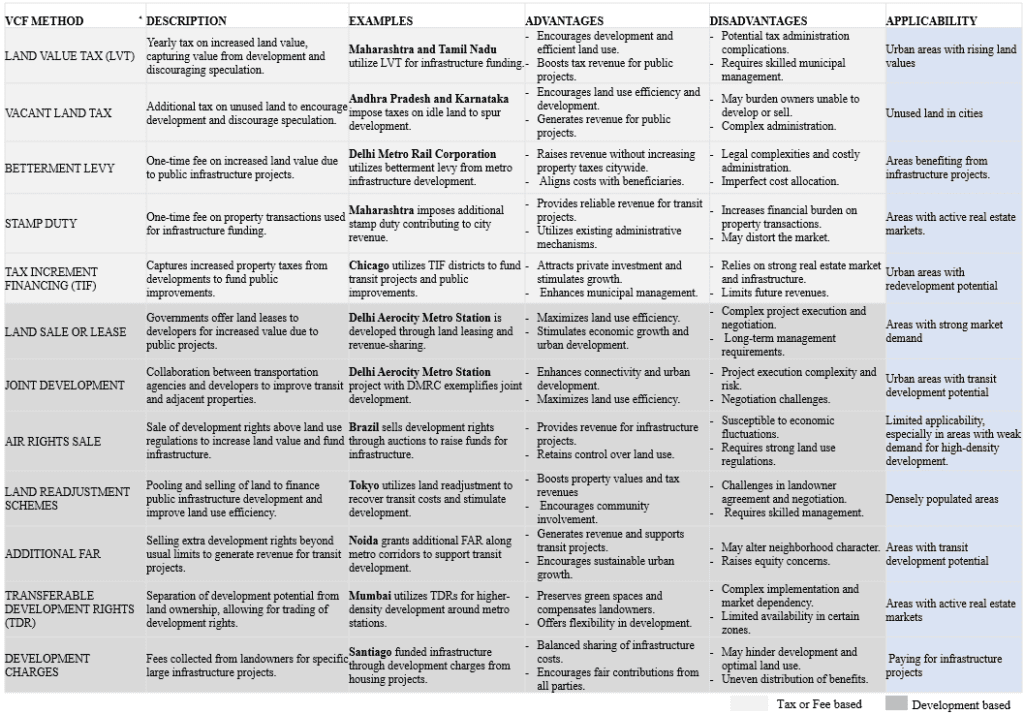

2 approaches to LVC:

- Development-based – Development-based capture occurs when the government invests in service or infrastructure deliveries so that property prices rise. Such an increment in value is captured through selling or leasing land, development rights, or air rights.

- Tax- or fee-based – Taxes or fees capture, or capturing value from the property owner through taxes or fees, including betterment charges or property taxes.

Source: author

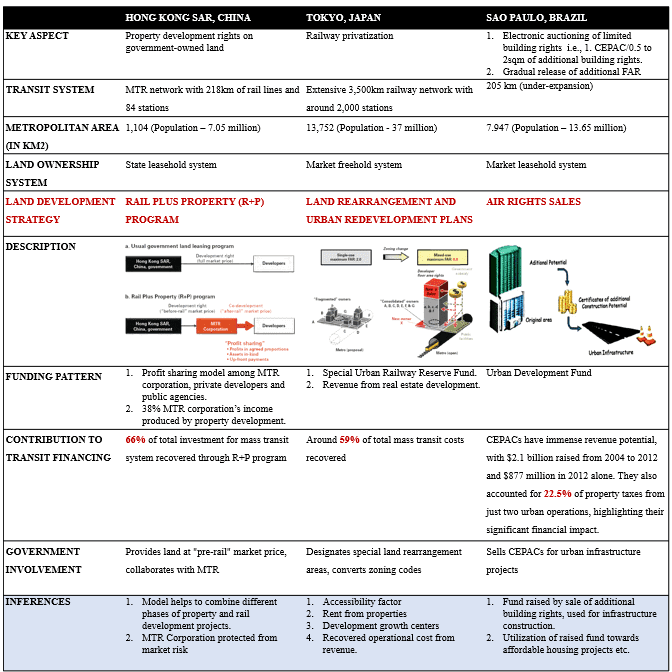

Global Case Studies in Land Value Capture: Successes, Challenges, and Lessons

Value capture has proved to be a means not only through which the operating costs can be recovered by the transit agencies but also through which they can generate funds for building new transit infrastructures.

For instance,

- Grand Paris Express project gained 80% of its cost through value capture.

- New York 7 Line Extension, Crossrail in London, raised 88% and 32% Housing is another major expense for cities.

- Hong Kong ‘Rail + Property’ harnessed the theory of value capture to build housing and commercial facilities around railway stations, and as of 2016, it had produced more than 100,000 housing units and commercial facilities measuring 2 million square meters. As shown by this model, significant income accrued to the rail company: 38% of its income from the development of property, and its ancillary enterprises 28%.

Value capture financing has been effective in cities across the world as it enables them to raise funds for investment, operation, and maintenance in transit (NIUA and Shakti Foundation, 2020).

Indian cities also require public infrastructure with an enormous amount of investment but these cities typically depend on government grants, revenue, and borrowing, which are mainly invested here and cannot invest elsewhere.

Source: author

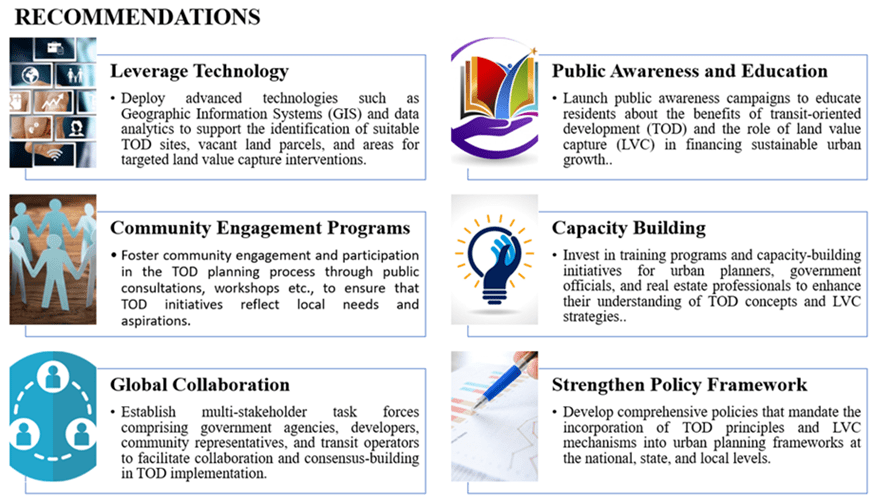

Challenges and Opportunities in Implementing LVC

CHALLENGES –

- Legal Obstacles: Most regions have poor and ambiguous laws to implement LVC.

Solution: Laws providing transparency to involve LVC into urban policy need to be introduced by the government.

- Land Value Change Calculation: Public investment causes a shift in land value, but its calculation is complex; hence, it leads to disputes.

Solution: Use technologies like GIS and big data analytics to increase accuracy in the calculation of change in land value.

- Public Reluctance: People generally consider LVC as additional tax and will resist it.

Solution: Public awareness programs highlighting the advantages of LVC and involving communities to build a positive trend.

OPPORTUNITIES –

- Infrastructure funding: LVC would become a sustainable source of financing urban projects, and it will be something that does not heavily depend on traditional taxes.

- Equitable growth: Of course, development of the land will be to the common good and not fall into land owners’ pockets.

- Sustainable growth: LVC promotes Transit-Oriented Development, which advocates for smart use of land.

- Technological insights: The implementation of LVC can more effectively and precisely be done by the induction of AI and big data.

- Public-private partnership

Source: author

The Future of LVC: A Sustainable Urban Growth Strategy

LVC stands out to be the future financing solution for urban development with the cities expanding and increasing the need for infrastructure.

- Problems of traditional funding mechanisms: The traditional funding mechanisms would not work as a solution for fulfilling the current rising needs of urban infrastructure; hence new funding mechanisms like LVC come into play.

- Fair and Sustainable Solution: LVC costs urban improvements are divided between its beneficiaries to ensure a more sustainable and fairer funding source.

- Budget Balancing: If and when put into proper practice, LVC allows municipalities to balance their budget without necessarily owing a greater burden on government budgets.

- Better Urban Living Environments: Following the generation of extra money, LVC will facilitate friendly calmness environments in cities due to better infrastructure coupled with public services.

- Global Examples: Successful application of LVC in Tokyo and Hong Kong proves the potential for transforming financing for urban infrastructure.

Therefore, LVC offers an alternative source of funding that helps in ensuring fairness and sustainability in urban development.

Source: author

Conclusion

Land Value Capture is great hope for sustainable urban development where the producers of land value pay toward the improvement costs of infrastructure.

Founded on Ricardo and George’s economic theories and later developed on by the Bid Rent Theory, LVC lies on the principle that “public investments increase land values, which can be captured by governments through a host of mechanisms.” Whether development-based or tax-based, these mechanisms have become a new source of revenue for cities often challenged to find funds for municipal functions.

Successful examples include Grand Paris Express, Hong Kong’s Rail + Property model, and New York’s 7 Line Extension. LVC can finance significant projects in infrastructure projects but faces huge problems like legal hindrances, public rejection, and political opposition. However, it also offers opportunities for equitable growth, sustainable development, and technological innovations to make it a sound instrument for urban planning.

LVC will unlock the door to sustainable growth in urbanization by opening up possibilities for transit-oriented development, ensuring the balance of municipal budgets, and perfecting better dwelling environments in towns and cities.

Under LVC, cities could make a fairer, more efficient and sustainable model of urban extension and public infrastructure financing.

References

- Suzuki, H. et al. (2015) FINANCING TRANSIT-ORIENTED DEVELOPMENT WITH LAND VALUES.

- Slegtenhorst, I. (2013) From Value Creation to Value Capture.

- Huxley, J. (2009) Urban Investment Network Value Capture Finance Making urban development pay its way, Urban Land Institute (ULI). Available at: http://uli.org/wp-content/uploads/ULI-Documents/Value-Capture-Finance-Report.pdf.

- MoHUA (2017) ‘Land Value Capture Policy Framework’, (February).

- NIUA and Shakti Foundation (2020) ‘VALUE CAPTURE FINANCE IN TRANSIT ORIENTED DEVELOPMENT: A Guide to Implementation A Guide to Implementation’. Available at: www.niua.org.

- OECD and Lincoln Institute of Land Policy, P.-L.I.C. (2022) Global Compendium of Land Value Capture Practices Policy Highlights, OECD. Available at: https://bityl.co/IYQV.

- WBG (2018) Land value caWBG (2018) ‘Land value capture’, Policy Brief Fy, 25417029(Lvc), pp. 2016–2019. Available at: http://archive.citiscope.org/story/2014/how-sao-paulo-uses-.pture, Policy Brief Fy. Available at: http://archive.citiscope.org/story/2014/how-sao-paulo-uses-.

Meena Saini

About the Author

Meena is a dedicated architect and urban planner celebrated for her innovative and sustainable design approach. A young professional, she combines technical expertise with imagination and inquisitiveness. Known for her transparency and adaptability, Meena offers creative, unconventional solutions to urban challenges. Her modesty belies a fast learner committed to excellence. Focused on enhancing urban environments through thoughtful, sustainable design, Meena is dedicated to making a significant impact in her field.

Related articles

Sustainable Revitalization of Historic City Centers

Cultural Routes as Catalysts for Urban Regeneration

UDL GIS

Masterclass

GIS Made Easy – Learn to Map, Analyse, and Transform Urban Futures

Session Dates

23rd-27th February 2026

Urban Design Lab

Be the part of our Network

Stay updated on workshops, design tools, and calls for collaboration

Curating the best graduate thesis project globally!

Free E-Book

From thesis to Portfolio

A Guide to Convert Academic Work into a Professional Portfolio”

Recent Posts

- Article Posted:

- Article Posted:

- Article Posted:

- Article Posted:

- Article Posted:

- Article Posted:

- Article Posted:

- Article Posted:

- Article Posted:

- Article Posted:

- Article Posted:

- Article Posted:

Sign up for our Newsletter

“Let’s explore the new avenues of Urban environment together “